“It’s the only business where the customer is always wrong,” says pawnbroker Mike Fink. “It’s not good to be in a position where you have to sell all your stuff.”

In Maine, more than in any other New England state, a growing number of households are finding themselves in that very position.

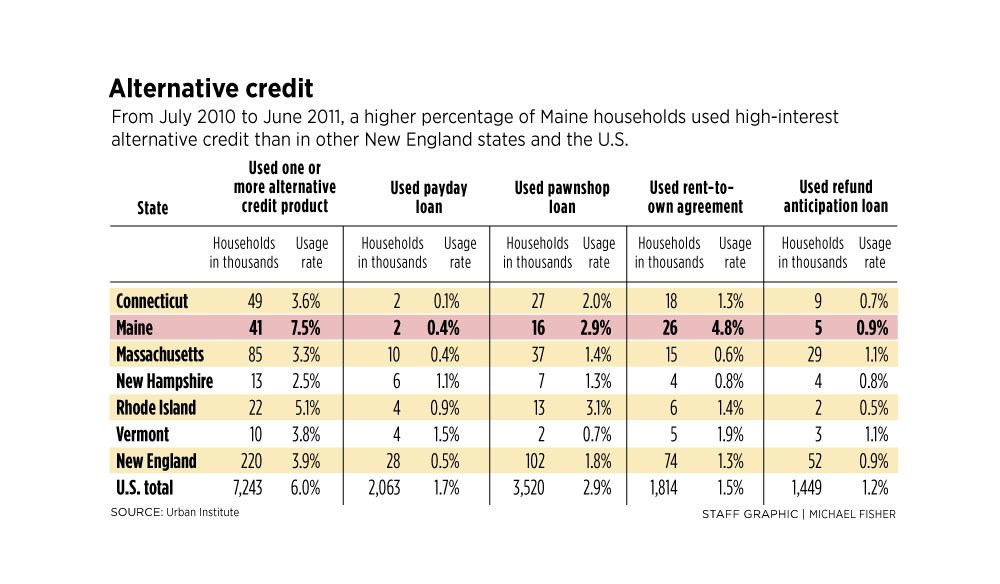

The percentage of households that use pawnshop loans, rent-to-own contracts and payday loans is on the rise in Maine and, at 7.5 percent, is far ahead of neighboring states, according to an analysis by the Federal Reserve Bank of Boston.

For using such services, more Mainers are getting trapped in a recurring cycle of debt as they pay up to 300 percent annual interest rates for short-term credit products that use personal property, rented household items and future paychecks or tax refunds as collateral, financial experts said.

Maine’s relatively high percentage of low-income households, a lack of financial literacy and the prevalence of pawnshops and payday loan and rent-to-own stores are to blame, they said.

Critics said they do not necessarily want to see such businesses go away, but that they would like the public to be better educated about the premium they are paying to use alternative credit products. Several rent-to-own and payday loan stores in Maine did not respond to interview requests for this article.

At Fink’s pawnshop, Guitar Grave in downtown Portland, customer Craig Campbell said he pawns personal items regularly to get through the month.

“I’m disabled … and I have a hard time waiting through the month for my disability check to come through,” the 39-year-old Portland resident said.

Campbell said banks won’t lend him money, which leaves him with few options for obtaining credit.

But while he returns to the pawnshop each month to pay interest on his existing loans, Campbell said it has been difficult to repay the loans and retrieve his gold jewelry and other personal effects.

“Sometimes it’s hard to find something that’s of value to bring in,” he said.

Fink said about two-thirds of his pawnshop loan customers end up repaying their debts, and the remaining third forfeit their items, which he then sells at discount prices. He has a basement full of guitars, electronics, jewelry and other pawned items awaiting their ultimate fate.

“I make out OK either way,” he said.

Fink said he generally is willing to lend about half the amount he believes he can get for the customer’s collateral. He charges up to 25 percent a month for the loans.

“It’s 300 percent a year – that’s why it’s a bad idea,” he said about pawnshop loans.

ALTERNATIVE CREDIT ON THE RISE

From July 2010 to June 2011, 7.5 percent of Maine households used some form of alternative credit, nearly twice the 3.9 percent average rate for New England and 25 percent more than the U.S. average of 6 percent, according to the Fed’s Boston office.

The New England state in which the smallest share of households used alternative credit during that time period was New Hampshire, at 2.5 percent, it said.

Those figures, based on a biennial household survey conducted by the Federal Deposit Insurance Corp., also show that 17.8 percent of Maine households with some form of a bank account patronized a rent-to-own store, pawnshop or payday loan store from mid-2010 to mid-2011, up from 17.6 percent during the same period two years earlier.

That’s an increase of only 1.1 percent, but the survey also showed that the percentage of all Maine households in which at least one member had used alternative credit products at some point in the past increased by half, from 12.7 percent in 2008-2009 to 19 percent in 2010-2011.

By far, the credit product most responsible for driving Maine figures so high was rent-to-own, according to the survey.

About 4.8 percent of Maine households reported using a rent-to-own store from July 2010 to June 2011, it said. That’s compared to the New England average of 1.3 percent, and the U.S. average of 1.5 percent.

By comparison, only 0.4 percent of Maine households used payday loan stores, lower than both the New England average of 0.5 percent and the national average of 1.7 percent.

About 2.9 percent of Maine households used pawnshop loans, equal to the national average and higher than the New England average of 1.7 percent.

Rent-to-own stores allow customers to obtain items immediately by agreeing to purchase the item by making regular payments over a set period of weeks. Customers can return the items without any damage to their credit scores if they fail to make their payments.

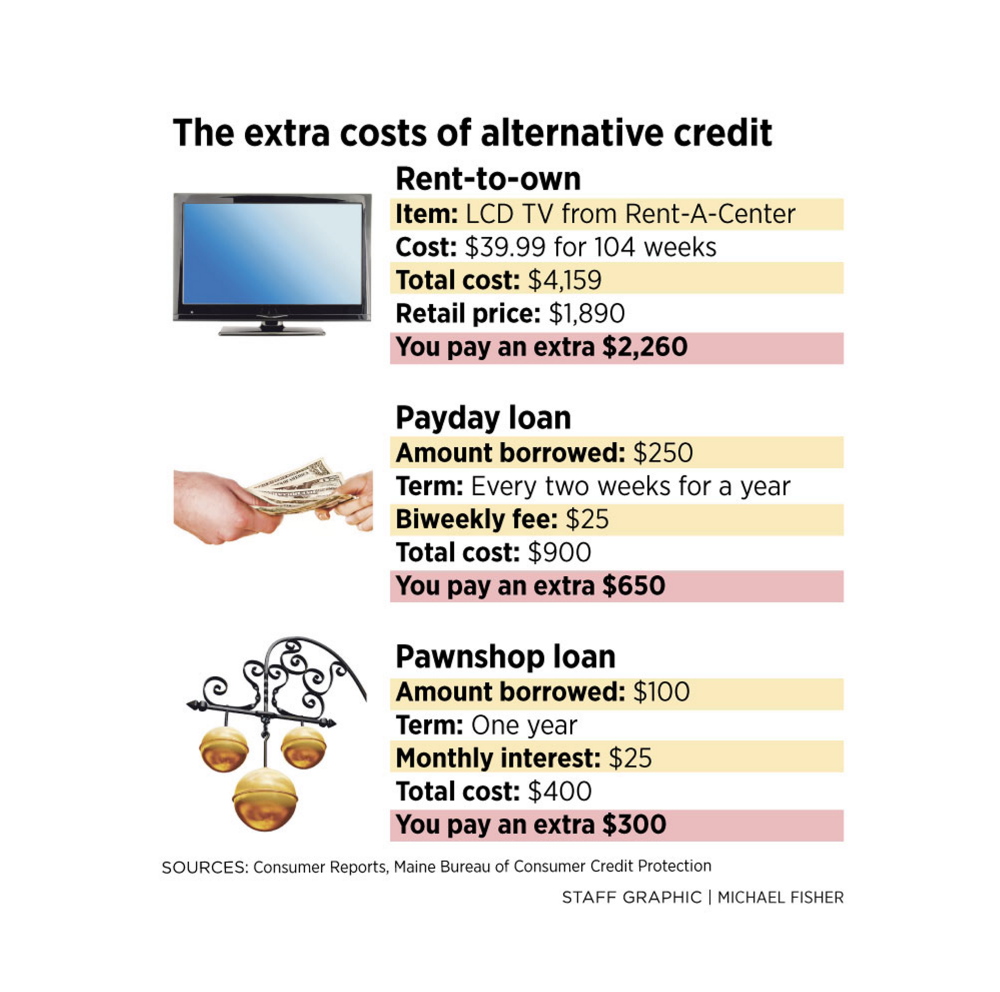

According to a 2011 investigation by the magazine Consumer Reports, rent-to-own stores generally charge customers the equivalent of a 100 percent to 300 percent annual interest rate.

For instance, it said, leading chain Rent-A-Center was offering an LCD television for $39.99 a week over a period of 104 weeks. That’s a total of $4,159, more than twice the television’s $1,890 retail price, Consumer Reports said.

“Even a high-interest-rate credit card is a better option than rent-to-own,” it said.

Xavier Dominicis, a corporate spokesman for Plano, Texas-based Rent-A-Center, said the purchase price includes added benefits such as delivery, setup, servicing and repairs.

The company also has a lenient return policy, and customers who are unable to complete their purchases can come back at any time and pick up where they left off, Dominicis said.

“It’s unusual flexibility,” he said.

Portland resident Stephanie Doyle said she has used Rent-A-Center three times in the recent past, to buy a living room set and bedroom sets for herself and her young daughter.

“I’ve gotten most of the furniture for my apartment (from Rent-A-Center),” the 26-year-old said. “It’s really beneficial to low-income people.”

Doyle said she still is paying off her daughter’s bedroom set, which comprises a bed, vanity dresser and nightstand. Her contract is for $112 a month for eight months, a total price of $896. Doyle said she did not do any research to determine the retail price for those items, nor did the store disclose it.

Despite the cost, Doyle said renting to own is superior to other options such as layaway, because customers get to take home their items right away.

“It’s better for low-income people, and Maine seems to have a lot of those,” she said.

CONSUMER AWARENESS

Gregory Mills, a senior fellow at the nonpartisan Washington, D.C., think tank Urban Institute, said the principal reason for Maine’s relatively high usage of alternative credit is the predominance of households earning between $15,000 and $30,00 a year.

That income range is the sweet spot for rent-to-own stores, pawnshops and payday loan stores, said Mills, author of the Boston Fed’s recent article on alternative credit products. The 2012 median household income in Maine was $48,219, but roughly 8 percent of Mainers fall within the U.S. Census Bureau’s definition of poor.

In other respects, Maine does not fit the typical profile of a state with high alternative credit use, he said.

Older consumers are the least likely to use such stores, as are whites, both of which Maine has in abundance, Mills said.

“It does just seem to be a rather straightforward issue of lower income,” he said.

The biggest problem with alternative credit providers is that they target the population least capable of shouldering their high interest rates, Mills said. Rent-to-own stores, pawnshops and payday loan stores tend to set up shop in low-income neighborhoods.

Still, many customers don’t have a full understanding of how much money they are spending on interest, he said.

“It’s only when you do that annualized calculation that you see how much it is,” Mills said.

Most pawnshops in Maine charge 300 percent a year, the maximum rate allowed. Payday loan stores can charge up to a $25 fee for loans of $250 or more, so borrowers who take out a $250 loan every two weeks for a year would pay a total of $650 in fees.

Renting-to-own can cost as little as 50 percent interest a year, Mills said, but it still adds up to a significant added cost, and rent-to-own stores primarily sell used items.

“These are households that are struggling,” he said. “It’s an unfortunate coping strategy that households use.”

Garrett Martin, executive director of the left-leaning Maine Center for Economic Policy, said another problem in Maine is the population’s generally poor financial literacy.

“This speaks to a lack of understanding of debt and the ability to manage debt,” Martin said. “These businesses take advantage of that.”

The percentage of Mainers who patronize rent-to-own stores is particularly alarming, he said. “It’s amazing how much higher we are here.”

Despite their high costs, it would be a mistake to ban high-interest, short-term loans entirely, Mills said.

Instead, consumers should seek financial counseling, work on budgeting and think of alternative credit products as something to use only in emergencies, he said. In addition, providers of short-term credit should do a better job of making consumers understand the costs.

“I think it’s problematic and worrisome,” Mills said. “But banning such products entirely is not a responsible choice.”

Send questions/comments to the editors.

Comments are no longer available on this story