A global energy company that abandoned plans two years ago to build a $120 million demonstration wind farm off the Maine coast following opposition from Gov. Paul LePage is moving ahead with a similar project in Scotland.

The decision is inviting an examination of what Maine may be losing in terms of jobs and private investment, as well as its ambitions to become a center of global research in an evolving, clean-energy industry.

“What we lost was the opportunity to be at the forefront of what some have predicted to be a trillion-dollar global offshore wind industry,” said Jeremy Payne, executive director of the Maine Renewable Energy Association.

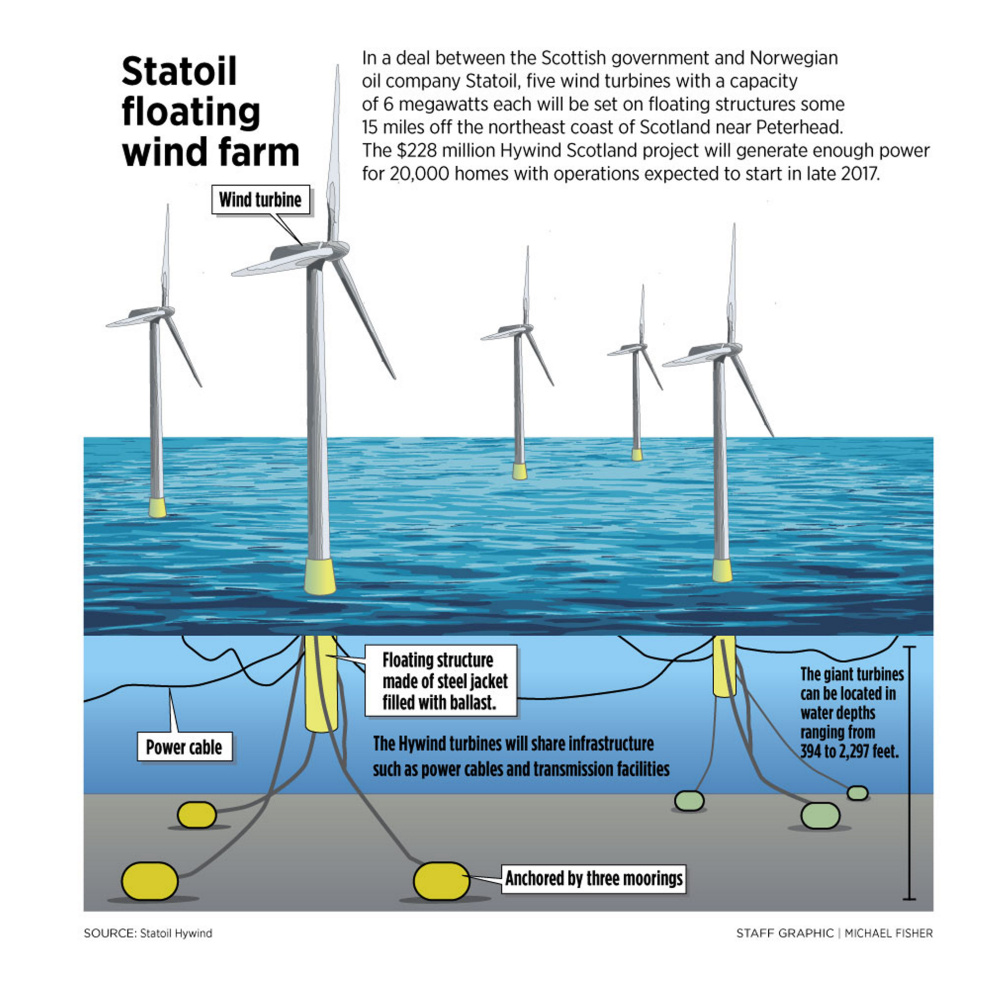

Norway-based Statoil announced this month that it had made a final decision to build Hywind Scotland, the world’s first floating offshore wind farm. The $228 million project will be located 15 miles off the northeast coast in Peterhead, near Aberdeen. Power production is set for late 2017.

Statoil launched the world’s first floating wind turbine in deep water off Norway in 2009. In 2012, the company proposed its next venture for multiple turbines, called Hywind Maine, at a state-approved site off Boothbay Harbor. It pulled the plug after LePage engineered a last-minute change in the Legislature that threatened Statoil’s business model by favoring a competing proposal based at the University of Maine.

Until last week, the prospects for the university-led project, called Maine Aqua Ventus, had faded, after it failed to win a first-tier grant from the U.S. Department of Energy. But the outlook improved after the agency announced last week that it would kick in $3.7 million to finish UMaine’s design work, which will position Maine Aqua Ventus to compete for a $47 million grant next spring. The funding will be essential to attracting private investors to build a pilot wind farm off Monhegan.

But in Payne’s view, Maine should have been where Scotland is now.

“Despite the recent encouraging news regarding the Aqua Ventus project’s recent receipt of a Department of Energy grant, more than two years have passed with scant progress made since Statoil was pushed out of Maine,” Payne said.

COMPARING ONE AGAINST THE OTHER

Europe has many wind farms anchored close to shore in the seabed. But energy researchers think they can produce even more power in deep water in places such as Maine, where winds are stronger offshore. Last week’s DOE news gave local businesses and renewable energy advocates hope that Maine could get back on the global radar as a place to test deep-water wind power.

But with Statoil preparing to build in Scotland, comparisons are inevitable:

• Statoil plans to be operating in Scotland late next year. It’s uncertain when Maine Aqua Ventus could be in the water, although the development team is shooting for 2019.

• Statoil apparently has the money to move ahead with construction, and says it’s doing so without government tax breaks from Scotland. When it was working on the Boothbay project, Statoil was seeking the same $47 million Department of Energy grant as Maine Aqua Ventus.

• Statoil’s project in Maine would have produced power at 27 cents per kilowatt-hour, based on its contract with the Maine Public Utilities Commission. That’s more than three times higher than an average home rate and roughly equal to the rate approved for Maine Aqua Ventus.

• The scale of the projects is also different. Hywind Scotland will consist of five turbines, with each rated at six megawatts. They will be atop floating spars anchored in more than 300 feet of water. The 30-megawatt output will power 20,000 homes. By comparison, the Boothbay Harbor wind farm would have been smaller, with four floating spars in 460 feet of water. They would have each supported 3-megawatt turbines that together could have powered 6,000 homes.

FINANCING AND JOBS

Finances also appear to be markedly different. LePage, who asked to revisit the power purchase agreement Statoil struck with state regulators in 2012 that led to the company’s departure from Maine, is opposed to subsidies for renewable energy projects because they increase the cost of electricity. He said at the time the extra cost of Statoil’s project was a burden to customers, although it would have added only 75 cents a month to a typical Central Maine Power home bill.

In Scotland, power production costs for the Hywind project are confidential. Statoil declined to give the Maine Sunday Telegram a specific number. It would say only that since launching the single turbine off Norway in 2009, costs have dropped by nearly 70 percent.

“With a good performance of the Hywind Scotland pilot park and a maturing of the supply chain for floating wind, we believe we will be able to deploy commercial-scale wind farms at the same cost level as other comparable power sources,” said Elin Isaksen, a spokeswoman for Statoil.

Statoil is taking advantage of at least one important financial incentive: an above-market power rate that utilities in the United Kingdom must pay for renewable energy. New England utilities have a similar mandate, although details vary between the two places.

In terms of investment, Statoil said it will spend $232 million in the Scotland pilot and create “significant” employment, although it didn’t specify job numbers. Two key components will be made in other countries – the turbines in Denmark and the substructure in Spain. But an operations base will be set up in Peterhead, Isaksen said. Most of the work in Scotland will be in steel fabrication for the substructures and anchors, she said, as well as marine operations and turbine assembly.

In Maine, Statoil had agreed to locate its operation center in the state. It also pledged to spend up to $100 million with Maine suppliers and contractors.

‘PART OF THE PUZZLE’

Another element in the comparison is Statoil’s ultimate intent of where to build its pilot wind farm.

It’s no secret that, even while it was focusing its attention on Boothbay Harbor, Statoil also was considering Scotland. And Patrick Woodcock, LePage’s energy director, said “there was concern” at the time that Statoil was headed to Scotland all along, where it could build a bigger, more expensive project than would have been allowed under Maine’s ocean energy law.

Woodcock didn’t directly answer the question of whether the LePage administration has had second thoughts about Statoil’s departure.

He replied: “The offshore wind industry needs to dramatically lower costs to economically contribute meaningful clean energy to U.S. electricity production. Innovation, like Statoil’s Hywind concept or the University of Maine’s Aqua Ventus design, are examples of the disruptive technology to make the resource cost-effective.”

But Annette Bossler, a wind energy expert who lives in Bremen and runs Maine(e) International Consulting, noted that Statoil needed to meet certain deadlines in the U.S. to get the $47 million federal energy grant.

“I believe they would have gone ahead with both projects, but not at the same time,” she said. “I think Maine would have happened first.”

The decision to build a bigger project in Scotland now, she said, reflects an economy of scale across the wind industry to produce more power with larger turbines. That, plus lessons learned since 2009, are driving down costs.

“Scotland now is part of the puzzle to demonstrate that floating offshore is cost-efficient,” Bossler said. “Investors won’t invest until they see a number of different projects with technologies that are reliable and cost-efficient.”

Send questions/comments to the editors.

Comments are no longer available on this story