WASHINGTON — President Trump on Thursday approved a proposed U.S.-China trade deal, raising hopes for a possible truce in a 21-month commercial conflict that roiled financial markets, disrupted corporate supply chains and cost taxpayers tens of billions of dollars.

At a White House meeting with his top trade advisers, the president signed off on a swap of U.S. tariff reductions in return for China spending $50 billion on U.S. farm goods, tightening its intellectual property protections and opening its financial services markets, according to Michael Pillsbury, a China expert at the Hudson Institute, who says the president briefed him on the deal Thursday.

“It’s a breakthrough,” Pillsbury said. “He says it’s historic. I certainly agree with that.”

The limited accord caps a roller-coaster negotiation that brought the two countries to the brink of success more than once this year only to see talks stall. Diplomats from the world’s two largest economies have been working against a Sunday deadline, when new U.S. tariffs on $160 billion in Chinese goods were scheduled to take effect.

That increase now will not go forward and existing tariffs on $360 billion in Chinese imports will also be reduced, according to Pillsbury and others familiar with the arrangement. The deal includes provisions that will penalize the Chinese government if it fails to place the required agricultural orders.

As of Thursday evening in Washington, the Chinese government had issued no official confirmation of a deal.

Still, the so-called “phase one” agreement leaves the thorniest issues in the U.S.-China trade dispute to future negotiations, which are scheduled to begin next year. China’s massive subsidies for state enterprises and its practice of forcing foreign companies to surrender technology secrets in return for access to the Chinese market will be the subject of “phase two” of the talks.

Pillsbury recounted that the president told him in a late-afternoon phone call that Trump anticipates those talks continuing past the November 2020 election. Pillsbury serves as an occasional outside adviser to the president.

For Trump, the China deal is part of a sudden flurry of policymaking that has dazzled official Washington in the past week, as House Democrats are advancing plans to impeach him next week.

This week alone, the administration has reached deals with lawmakers to provide federal workers with 12 weeks of paid parental leave, establish a new military branch called “Space Force,” revise a proposed North American trade deal, and broker a budget deal that would prevent a government shutdown later this month.

“It’s very ironic: In some ways, this has been the best week of Trump’s presidency, and it’s happening at the very moment impeachment is reaching its crescendo,” said Stephen Moore, who advises Trump on economic policy and visited the White House for policy discussions this week. “It’s been revealed by their actions that the strategy was to go on a policy offensive as a way to play defense against impeachment, and it’s made Trump look unfazed by this.”

Plans for announcing the deal, including whether an official text will be made public, remain in flux. The administration has said it does not intend to seek congressional approval of the agreement.

“The deal is essentially done. The mechanics of how you execute it and how you get it signed still have to be worked out,” said one person briefed on the White House’s deliberations, who requested anonymity because they were not authorized to speak to the press.

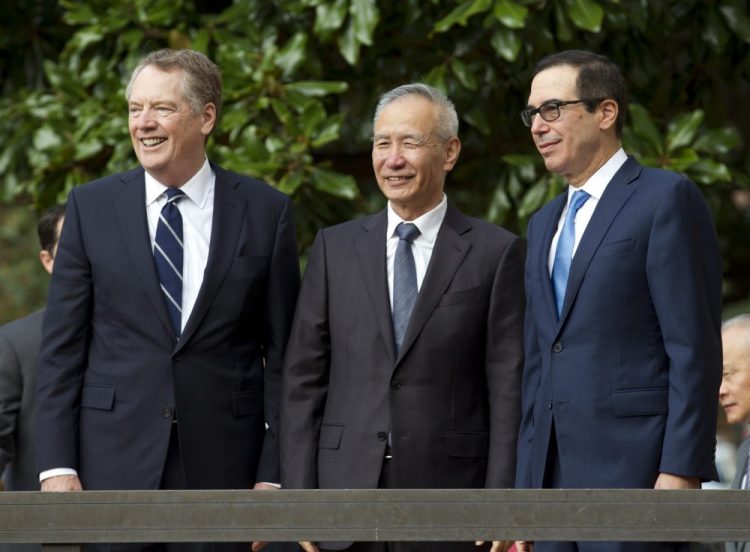

Under one scenario, Robert Lighthizer, the president’s chief trade negotiator, and Chinese Ambassador to the U.S. Cui Tiankai could sign the document as soon as Friday. Alternatively, Lighthizer and Treasury Secretary Steven Mnuchin could travel to Beijing for the signing.

Administration officials expect that Trump will benefit politically from sealing a deal with China. His decision to confront Beijing over its discriminatory trade practices was backed by business and farm groups who had felt the sting of Chinese behavior. Trump began imposing tariffs on Chinese imports in March 2018 in an effort to pressure Beijing to overhaul its state-dominated economy. Chinese leaders retaliated, halting purchases of U.S. farm products, in a bid to pressure some of Trump’s strongest supporters.

As the trade war escalated, costs mounted. Assembly lines were disrupted, as manufacturers petitioned the administration for permission to continue importing tariff-free Chinese parts they depended on to operate. In August alone, more than 10,000 workers were laid off, collateral damage from the trade war’s salvos. To mollify farmers, a politically potent constituency that lost lucrative Chinese sales, Trump doled out $28 billion – an amount that was more than double the controversial 2009 rescue of the auto industry.

Some were unimpressed with Thursday’s news.

“It is unclear that much will really be gained from the deal other than partially unwinding some of the disruptions created earlier this year while leaving other uncertainties in place,” economists at J.P. Morgan told clients.

Business leaders who have grown anxious for relief from the trans-Pacific tariff wars welcomed the development. “That is excellent news. It puts a floor under the deterioration in the relationship,” said Craig Allen, president of the U.S.-China Business Council.

Myron Brilliant, executive vice president of the U.S. Chamber of Commerce, said the deal would benefit American manufacturers and farmers. “It’s an important first step, but just a first step,” he said. “There is more work to be done.”

Several people close to the talks said the administration had not shared with them the text of the deal, which they described as an “agreement-in-principle.”

Even before a formal presidential decision to proceed, Republican critics of the so-called “Phase One” agreement sounded the alarm.

Sen. Marco Rubio, a Florida Republican and member of the Senate Foreign Relations Committee, warned against settling too quickly with Beijing. “@WhiteHouse should consider the risk that a near-term deal with #China would give away the tariff leverage needed for a broader agreement on the issues that matter the most such as subsidies to domestic firms, forced tech transfers & blocking U.S. firms access to key sectors,” Rubio tweeted.

Derek Scissors, a China hawk with the American Enterprise Institute and occasional administration adviser, accused the president of rushing to make a deal. “This timing is really weird,” Scissors said. “Technically, there’s been a deal on the table for the president to sign for some time. What’s changed is they think the president will say ‘yes.'”

Early Thursday morning, Trump teased investors with word of a potential deal with China, sending the stock market briefly higher amid optimism about a breakthrough in the lengthy standoff.

“Getting VERY close to a BIG DEAL with China,” the president tweeted shortly after Wall Street opened. “They want it, and so do we!”

The Dow Jones industrial average quickly rose more than 300 points, or roughly 1 percent, within the first hour of trading as financial markets cheered the prospect of a “Phase 1” deal with China. The market later surrendered some of its gains, though, and closed at 28,132.05, up almost 221 points or 0.8 percent.

The emerging deal would fall well short of the president’s initial goal: a comprehensive settlement of U.S. complaints about subsidized Chinese state businesses and trade secrets theft.

The president has often suggested the two sides were close to a deal only to see negotiations stall in the past. In April, Trump said the White House and Chinese negotiators were within weeks of an “epic” deal. The next month, talks collapsed amid U.S. charges that Beijing had reneged on a tentative bargain.

Progress with China comes as the White House is celebrating victory on another front in Trump’s trade wars. This week, House Democrats agreed to support a revised version of a new North American trade deal, which the president had signed last year with Mexico and Canada.

House Speaker Nancy Pelosi, D-Calif., backed the agreement after securing amendments that toughened enforcement of labor and environmental standards. The modified accord also dropped an extension of patent protections for a class of new drugs known as biologics, which Democrats said would lead to higher prescription drug prices.

The new U.S.-Mexico-Canada Agreement is expected to reach a House vote next week and clear the Senate early next year. Once approved by the legislatures in each country, it will supplant the 1994 North American Free Trade Agreement, which Trump has called “our country’s worst trade deal.”

The bipartisan cooperation on trade is occurring even as House Democrats move forward with plans to impeach the president over his demand that Ukraine announce an investigation of one of his political rivals before receiving $391 million in congressionally authorized military aid.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.