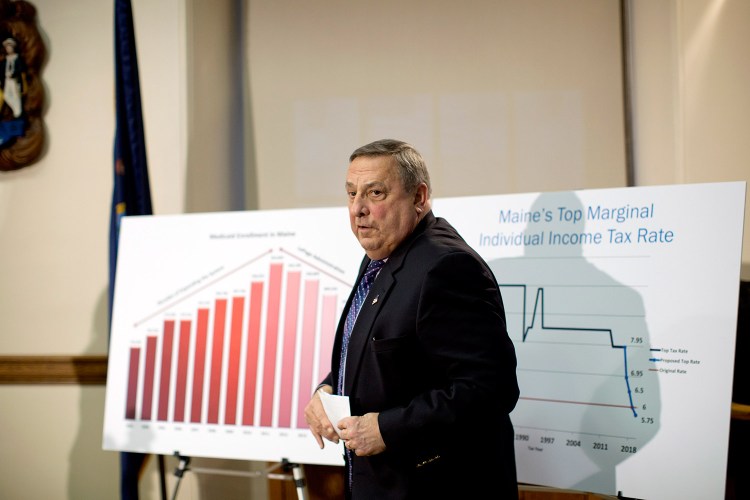

Gov. Paul LePage is expected to use his State of the State address next Tuesday to advocate for his complex and controversial two-year budget plan, which includes a significant overhaul of the state tax code.

The speech will be delivered to a joint convention of the Legislature in the House of Representatives chamber at 7 p.m. Legislative leaders from both parties are expected to make statements later in response to the governor’s remarks.

Adrienne Bennett, the governor’s spokeswoman, said Monday that LePage will use the speech to continue his public campaign for the budget and state tax code revision, which was unveiled Jan. 9.

The tax package is a pillar of LePage’s $6.3 billion budget, and it’s under intense scrutiny from Republicans, who control the Senate, and Democrats, who have the majority in the House. The budget is now in the hands of the Legislature, which has begun quietly dissecting the plan and will ultimately decide which elements to include in the state’s next budget, which goes into effect July 1.

There are a number of provisions in the budget that Democrats could support but Republicans may reject – and vice versa. Yet some of the major proposals are central to the overall package, meaning lawmakers will have to decide if excessive tinkering during negotiations will unravel the entire proposal and force them to start from scratch.

It’s the Republican governor’s tax plan that’s giving Republican lawmakers the most heartburn. The plan proposes to reduce Maine’s income tax while eliminating the estate tax. It also would reduce the top corporate income tax rate. Republicans support those measures, but many of them have campaigned in the past against proposals that are now a key part of LePage’s plan, such as taxing services like haircuts, amusements and legal services.

Sen. Thomas Saviello, R-Wilton, said last week that many of the more conservative members are having difficulty embracing the proposal.

“I think this was a shock to a lot of them,” said Saviello. “It was to me, too, but I find myself agreeing with much of what he’s trying to do with this. For others, I think they wanted to see a full repeal of the income tax, which is a very difficult thing to do, if not impossible, in one budget.”

Democrats, meanwhile, are focusing their measured resistance on a provision that would eliminate state aid to municipalities and give them the authority to raise replacement revenue by taxing nonprofits with $500,000 or more of assessed property value.

The most recent data available from Maine Revenue Services offers an incomplete picture of the impact, but suggests that larger towns will fare much better than rural communities that would have no eligible nonprofits to tax to generate the money that’s needed to pay for local services and education and hold the line on property taxes.

Many of the towns that may have trouble generating revenue from nonprofits helped deliver LePage his electoral victories in 2010 and 2014. And Republican lawmakers have opposed the governor’s previous attempts to eliminate revenue sharing. Last year, the Democratic-controlled Legislature persuaded Republicans to support a measure that took $40 million out of the state’s emergency fund to restore municipal aid that had been cut in the budget approved in 2013.

This time around, the governor has included money in his budget to encourage towns to consolidate services, while arguing that localities can tighten their budgets.

Democratic House Speaker Mark Eves of North Berwick said in a statement the party was concerned about the structure of the income tax proposal.

“What Mainers need are tax cuts that actually lift the middle class, making their hard-earned dollars go further,” Eves said. “As it stands right now, the governor’s proposal squeezes the middle class and puts enormous pressure on local towns and schools in order to give tax breaks to the very wealthy and corporations. These kinds of policies won’t help grow jobs or strong wages at a time when our state lags behind the nation in both areas.”

Eves added that the revenue sharing elimination would also lead to higher property taxes for many communities or a cut in local services.

“This week’s historic blizzard is a reminder of just how critical state funds for towns are for ensuring streets are plowed and our communities are safe,” he said. Eves said Democrats would also oppose a plan to cut the state’s Drugs for the Elderly program.

“Meanwhile, we see little investment to help seniors live independently longer, which is a key priority for Democrats this session,” he added.

Bennett, LePage’s spokeswoman, said the administration may be releasing an analysis of the impact of various elements of the tax plan. She said the governor also plans to submit an opinion column to a national news outlet to lobby for the budget, but did not say which one.

LePage’s tax plan is generating some national attention. The New York Times included his proposal in a national story detailing how Republican governors across the nation are proposing tax increases to meet state revenue needs and pay for an array of initiatives. Such proposals have bucked the rhetoric of the Republican National Committee, but suggest that many Republican governors, including conservatives like LePage, are choosing the path of pragmatism in order to attract bipartisan support.

Copy the Story LinkSend questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.